Mastering the Art of Importing: Navigating the Complexities of Chinese Trade and Regulations

When importing goods from China, there are several factors and regulations to consider:

-

Trade agreements: Check if your country has any trade agreements with China that may impact import duties and taxes.

-

Tariffs and taxes: Understand the import duties, taxes, and fees associated with importing goods from China into your country. These costs can vary depending on the type and value of the goods, as well as the country of origin and destination.

-

Import regulations: Familiarize yourself with your country's import regulations, including any restrictions or bans on specific products, as well as required permits or licenses.

-

Product compliance: Ensure the products you plan to import meet the safety, quality, and labeling standards of your country. This may include compliance with regulations such as CE, RoHS, or FCC.

-

Intellectual property rights: Be cautious of importing counterfeit or pirated goods, as this can lead to legal disputes and penalties.

-

Shipping and logistics: Choose a reliable freight forwarder or shipping company that specializes in international shipping, customs clearance, and logistics management.

-

Customs documentation: Prepare the necessary customs documentation, such as commercial invoices, packing lists, bills of lading, and certificates of origin, to facilitate a smooth customs clearance process.

For the most up-to-date import notices from China, visit official government websites, customs agencies, or consult with a professional customs broker or freight forwarder who specializes in international trade with China. They can provide you with the latest information on import regulations, requirements, and any potential changes that may impact your shipments.

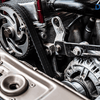

- Posted in Automotive, Autoparts, Import, Industry, Supplier